Borang E / Form E

What is Borang E/Form E?

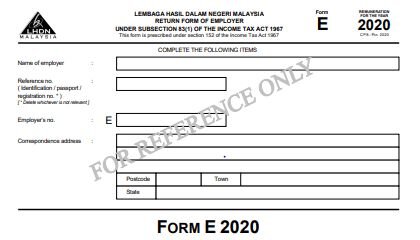

Form E serves as a declaration report to inform LHDN of the number of employees in the company and their income details. Employers must submit general Form E no later than 31st March every year.

Meanwhile, the E filing submission deadline is one month after the due date (30th April). Failure to do so may result in a fine of RM200 to RM20,000, or imprisonment for a term not exceeding 6 months, or both.

Are you obligated to submit Borang E / Form E?

Since 2016, all companies, with or without employees, must submit Form E to LHDN. This extends to dormant companies and companies not in operation. As of 2021, this extends to dormant companies, limited liability partnerships, trust bodies and co-operative societies.* Individuals (freelancers, gig workers, etc.) are not obligated to file Form E.

*https://phl.hasil.gov.my/pdf/pdfam/ExplanatoryNotes_E2021_2.pdf

Understanding Form E

Form E serves to report the total number of employees in a company, the number of new employees, employer’s details, employees’ details and their incomes.

What Are the Details Needed in Borang E/Form E?

- Employer’s details

- Employee’s details (for employees with yearly gross remuneration of RM34,000 and above or for employees with a monthly gross income of at least RM2,800 [including bonuses but does not include the salary arrears of previous years]). Meanwhile, for employees who do not meet the requirement, the employee’s data in Part A can be filled with “0”.

What You Need To Remember

- For companies, Form E can only be submitted online and LHDN has the right to reject paper or manual submission under the Income Tax Act 1967.

- Meanwhile, non-companies may submit online via e-Filing or a physical copy through postal or walk-in.

Generate Form E with Kakitangan.com

Kakitangan.com helps you to generate and distribute accurate payslips and Form E seamlessly.

Run your payroll with us and let us do the work.

Learn more